October 30, 2025 • 33 min read

October 30, 2025 • 33 min read

Ananya Namdev

Content Manager Intern, IDEON Labs

"The best marketing doesn't feel like marketing. It feels like a conversation with someone who understands your needs."

— Seth Godin, Marketing Expert and Best-Selling Author

The Facebook Ad Library is Meta's free transparency tool that lets you search and analyze active ads across Facebook, Instagram, and other Meta platforms. It's valuable for competitor research and ad inspiration, but has significant limitations: no download options, basic filtering, and a clunky interface.

This guide covers:

Bottom line: The tool is free and useful for basic research, but professional marketers need more advanced solutions for comprehensive ad intelligence.

The Facebook Ad Library (officially called the Meta Ad Library) is a searchable database launched in 2018 that provides transparency into all active advertisements running across Meta's family of apps: Facebook, Instagram, Messenger, and Audience Network.

Meta created this tool primarily for transparency around political advertising, but its value extends far beyond that. According to Meta's transparency reports, the library contains data on millions of active ads, making it one of the largest publicly accessible advertising databases in the world.

For digital marketers, e-commerce brands, and agencies, this represents an unprecedented opportunity to understand competitor strategies without spending a dollar.

What you can do:

According to HubSpot's marketing statistics, 73% of marketers say competitive intelligence directly impacts their campaign strategy. The Facebook Ad Library gives you free access to this intelligence.

💡 PRO TIP: The most valuable ads to study are those that have been running for 2+ months. If a competitor keeps an ad active that long, it's probably performing well.

Accessing the tool is straightforward. Visit facebook.com/ads/library directly through your browser. No Facebook account is required, though logging in may provide a slightly smoother experience.

The interface presents three primary filter options:

1. Ad Category Selection Choose between "All ads" (default), "Issues, elections or politics," or "Housing, employment or credit." Most marketers will use "All ads" for competitor research.

2. Geographic Location Select the country where you want to see ads. This is crucial because advertisers often run location-specific campaigns. The default is usually set to your current location.

3. Search Method You can search by advertiser name or by keyword. Searching by advertiser name shows all ads from that specific page, while keyword search attempts to find ads containing those terms.

When you search for a brand, results display as cards showing:

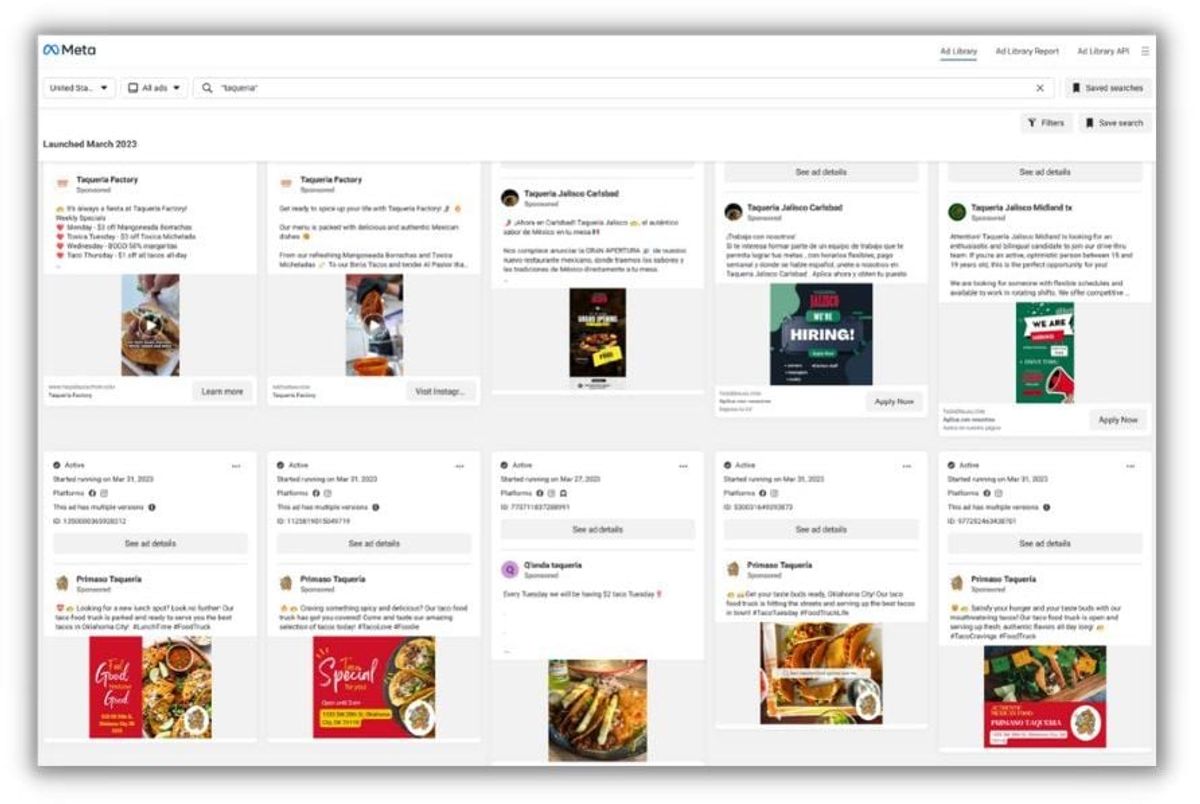

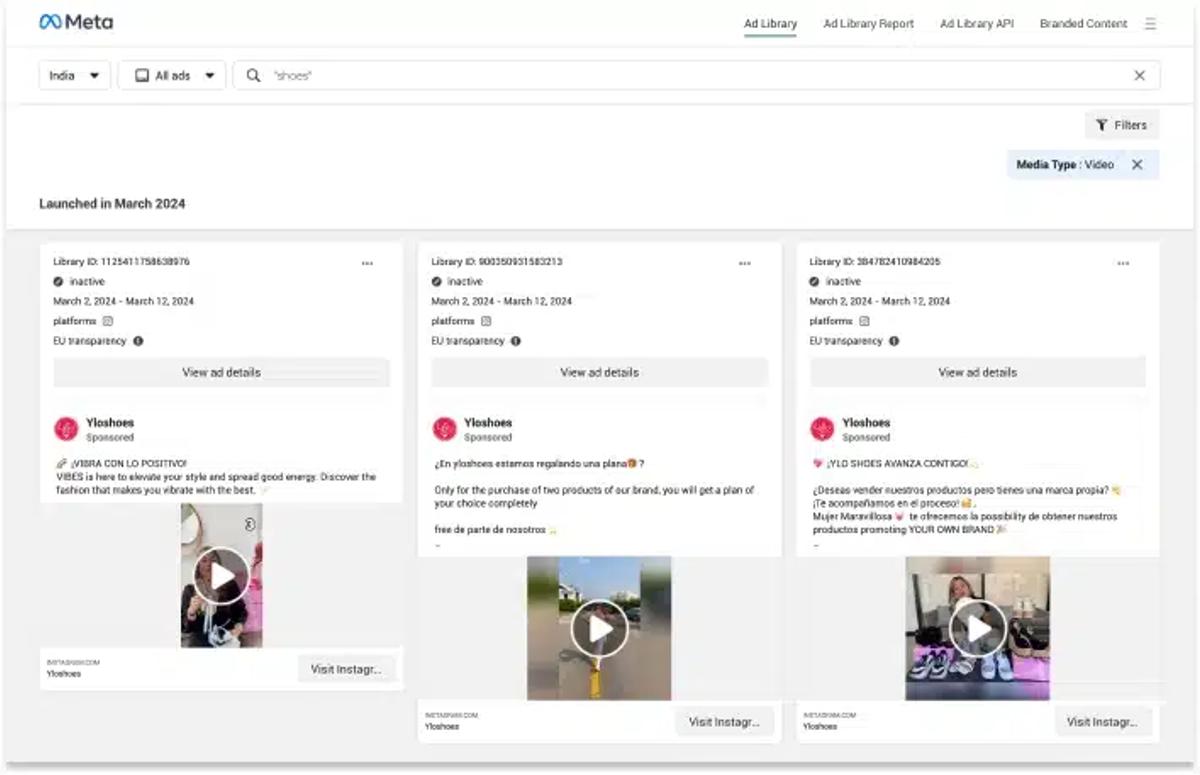

Example search results page showing multiple ads

While basic search is straightforward, mastering advanced techniques can significantly enhance your research efficiency.

The most reliable method is searching for exact advertiser page names. Type the brand or company name into the search bar, and the library will display matching pages. Select the specific page to view all their active ads.

⚠️ IMPORTANT: Many brands operate multiple Facebook pages for different regions or product lines. Make sure you're viewing the correct page by checking the page name and follower count.

Example workflow:

Search "Nike"

Multiple Nike pages appear (Nike Running, Nike Basketball, Nike Women, etc.)

Select the page relevant to your research

View all active ads from that specific page

Multiple brand pages appearing in search results

Keyword search looks for terms in ad text, but results are often incomplete or miss relevant ads. Use this method when you want to:

Limitations to know:

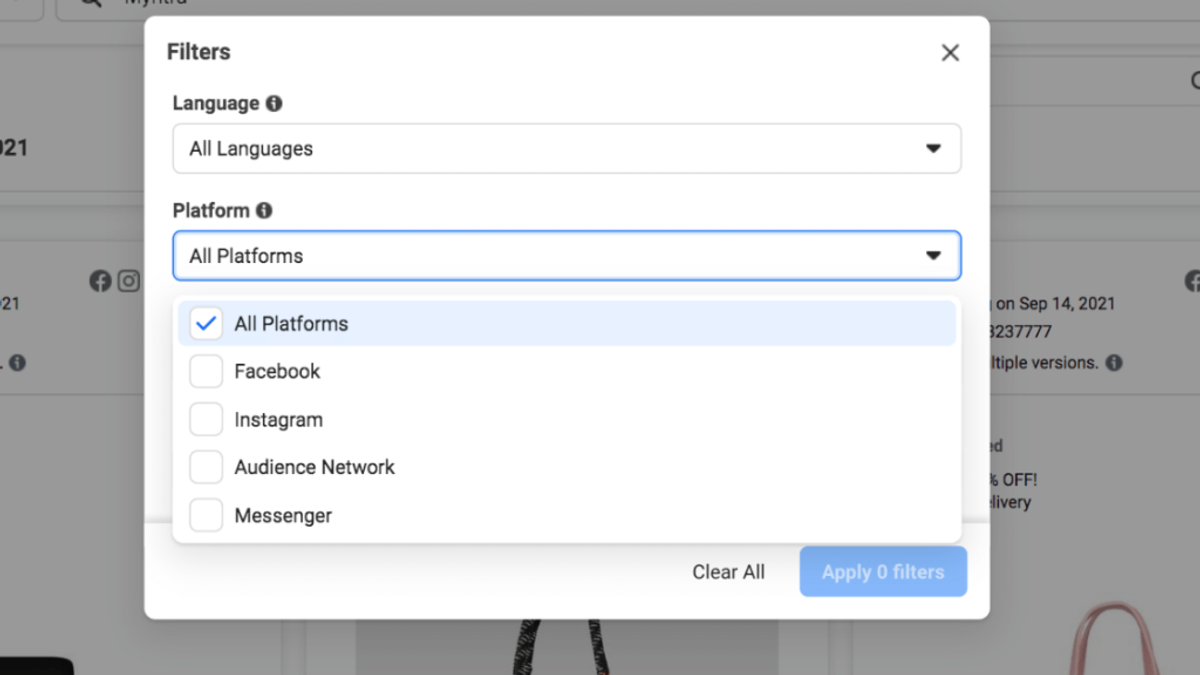

Once you've pulled up a brand's ads, you can filter by:

💡 PRO TIP: If you see an ad that started running 6+ months ago, screenshot it immediately. Long-running ads are proven winners, and they might stop running at any time.

Platform filter options in the facebook ad library

Strategic use of the tool provides competitive intelligence that can transform your advertising approach. Here's what to look for and why it matters.

By analyzing competitor ads, you can identify:

Creative formats they prioritize: Are they using carousel ads, video ads, or static images predominantly? This reveals what's working for them in your shared market.

Messaging themes:

Seasonal campaigns: Track how competitors adjust messaging around holidays, sales events, or product launches. This helps you plan your own seasonal strategy.

Testing patterns: Brands running multiple variations of similar ads are clearly A/B testing. You can see what variables they're testing (headline, creative, offer, etc.) without spending a dollar on tests yourself.

The ad library reveals how competitors communicate value:

According to Social Media Examiner's research, understanding competitor messaging is one of the top three factors that influence successful ad campaigns.

Analyzing multiple competitors simultaneously helps identify industry trends:

📊 INSIGHT: If you notice 3+ competitors in your space all launching similar campaigns within weeks of each other, that's a strong signal about what's working in your market right now.

While the library shows the ads themselves, clicking through to destination URLs reveals competitor landing pages and sales funnels. This end-to-end view helps you understand their complete customer acquisition strategy.

Different businesses extract different value depending on their goals. Here's how to use the tool for your specific situation.

E-commerce marketers can monitor competitor product launches, promotional strategies, and seasonal campaigns.

What to track:

Practical workflow:

Identify your top 5 direct competitors

Check their ads every Monday morning

Screenshot any new product launches or promotions

Note patterns in their promotional calendar

Plan your launches to avoid or embrace competitive timing

However, manually tracking all this information across multiple competitors becomes overwhelming quickly. Many e-commerce brands use advanced tools for automated tracking with historical data that shows seasonal patterns over time.

Digital marketing agencies use the tool to:

According to WordStream's agency benchmark report, agencies that provide regular competitive intelligence see 42% higher client retention rates.

Agency workflow tip: Create a standardized competitive report template that you deliver monthly to each client. Include:

Small businesses with limited advertising budgets can "borrow" strategies from larger competitors who've already invested heavily in testing and optimization.

What to "borrow":

💡 PRO TIP: Don't copy ads directly (that's unethical and potentially illegal). Instead, understand the underlying formula and apply it to your unique value proposition.

Content creators can research which brands are advertising heavily in their niche, understand their messaging, and identify potential partnership opportunities by seeing which brands have significant ad budgets in relevant categories.

One of the most requested features is the ability to download and save ads for reference, but the native tool doesn't offer this functionality.

Currently, the only way to save ads without third-party tools is taking screenshots of each ad individually.

Why this is problematic:

Professional marketers need to download ads because:

Team collaboration: Share competitor insights with designers, copywriters, and strategists without sending 50 individual screenshots

Swipe file creation: Build organized libraries of high-performing ad examples categorized by objective, industry, and format

Presentation materials: Include competitor examples in client presentations or strategy decks without scrambling to find them again

Long-term tracking: Monitor how competitor creative evolves over months and years

Professional ad intelligence platforms solve this limitation with bulk download capabilities. You can download entire competitor ad libraries in minutes with all metadata organized automatically—including ad copy, images, videos, start dates, and platform information.

This feature alone saves marketers 10-15 hours per week compared to manual research.

While the tool is valuable, it's crucial to understand its significant limitations before relying on it as your sole competitive intelligence solution.

The most glaring limitation: you can't see how ads actually perform.

There's no data on:

What this means: You're analyzing ads in a vacuum without knowing which ones are actually successful. An ad running for 3 months might be performing great, or the advertiser might have simply forgotten to turn it off.

The library only displays ads that are currently running, which creates significant blind spots:

Real-world impact: If you check a competitor in December and they're running holiday campaigns, you can study those. But if you check again in January, those campaigns are gone forever—no way to reference them for next year's planning.

This is one of the most significant limitations for serious marketers who need historical archives to track how competitor strategies evolve across seasons and years.

The interface feels like an afterthought rather than a professional research tool:

Time cost: Researching 5 competitors thoroughly can take 2-3 hours of manual scrolling and screenshotting.

Many experienced marketers have noticed that the tool doesn't always show all active ads. Searches sometimes miss ads that are clearly running, particularly:

Professional marketers need to:

None of these functions exist, forcing marketers to develop manual workarounds or seek alternative solutions.

⚠️ REALITY CHECK: If competitive intelligence is a regular part of your marketing process, the free tool's limitations will cost you more in time than a paid alternative costs in money.

The limitations above have created demand for more sophisticated ad intelligence tools. Here's when the free tool is enough, and when you need to upgrade.

The library remains appropriate for:

Consider upgrading to a dedicated ad intelligence platform when:

Time efficiency matters: You're spending 10+ hours per month on manual competitor research, and your time is worth more than the cost of automation

You manage multiple clients or brands: Agencies and in-house teams juggling multiple competitive landscapes need organized, scalable solutions

You need historical data: Tracking seasonal patterns, year-over-year creative evolution, or long-term strategy shifts requires archives

Team collaboration is important: Multiple stakeholders need access to organized competitive intelligence

Your advertising budget is significant: If you're spending $50K+ per month on ads, better intelligence has clear ROI—even a 5% improvement in performance pays for the tool many times over

You require presentation-ready insights: Client-facing agencies need polished competitive reports, not scattered screenshots

Professional ad intelligence platforms address every major limitation:

Advanced filtering and search:

Bulk download capabilities: Download entire competitor ad libraries in minutes with all metadata organized automatically

Historical archives: Access ads that stopped running months or years ago to track seasonal patterns and strategy evolution

Performance insights: Estimated engagement metrics and performance indicators help identify which competitor ads are likely performing best

Organization and collaboration:

AI-powered analysis: Automated pattern recognition identifies trending creative themes and messaging approaches

Real-time alerts: Get notified when competitors launch new campaigns

Maximizing value from the tool requires understanding its search nuances and developing efficient workflows.

1. Start broad, then narrow Begin with general advertiser searches for major competitors, then expand to adjacent brands and emerging players in your space.

2. Use multiple search variations Brand names might be listed differently than you expect. Try variations, common misspellings, and abbreviated versions.

Example: "Coca Cola" vs "Coca-Cola" vs "Coke"

3. Check multiple geographic locations Competitors often test campaigns in different markets before rolling out globally. Search key markets separately:

4. Establish a regular monitoring schedule Set up a weekly or bi-weekly routine to check key competitors. This helps you spot new campaigns quickly and understand testing patterns.

💡 PRO TIP: Add competitor checks to your calendar as recurring tasks. Monday mornings work well—you'll catch weekend launches and stay ahead of the week.

Professional marketers develop systematic approaches:

Step 1: Competitor list maintenance Keep a spreadsheet of all competitors and adjacent brands to monitor:

Step 2: Search cadence

Step 3: Documentation process Screenshot or document notable ads immediately with observations:

Step 4: Team sharing protocol Establish how insights get shared:

Even when using the free tool, complementary approaches enhance research:

Screenshot tools:

Organization software:

Spreadsheet templates: Track competitor campaigns over time with organized data. Include columns for:

However, most serious marketers find that makeshift solutions still don't match the efficiency of dedicated platforms, which integrate all these functions in one place with superior organization, search, and analysis capabilities.

For those new to competitive ad research, understanding the foundational elements is crucial.

Each ad includes specific information:

Started Running: When the ad first went live. Ads running 2+ months are likely performing well.

Platforms: Where the ad appears:

Ad Creative: The visual element—image, video, carousel, or collection

Primary Text: The main ad copy appearing above the creative (up to 125 characters show before "see more")

Headline: The bolded text below the creative (up to 40 characters)

Description: Additional text below the headline (less commonly used)

Call-to-Action: The button type:

For ads about social issues, elections, or politics, the library provides enhanced transparency:

While most marketers focus on commercial ads, this enhanced data for political ads demonstrates what's technically possible in terms of ad transparency.

Let's walk through a practical, repeatable process for conducting competitive research.

Create a comprehensive list including:

Direct competitors: Same products/services, same target audience, same price range

Indirect competitors: Solving the same problem differently (e.g., if you sell meal kits, restaurants and grocery delivery are indirect competitors)

Aspirational brands: Larger companies you're learning from, even if you're not directly competing yet

Emerging competitors: New entrants in your space who might disrupt the market

Aim for 15-25 total brands to monitor, with 5-7 in your top-tier check weekly.

For each competitor:

Search their brand name

Note the total number of active ads (indicates ad spend level)

Scan through all ads to get a general impression

Screenshot 5-10 representative ads from each competitor

Document initial observations

What to note:

Look for patterns across competitors:

Visual style:

Color schemes: What colors dominate in your industry? This reveals what catches attention in your specific market.

Copy length: Short, punchy headlines (5-7 words) vs. detailed benefit descriptions (20+ words)

Offers:

Categorize competitor messaging:

Pain points they address: What problems do they acknowledge their audience has?

Benefits they emphasize: Do they focus on time savings, money savings, convenience, quality, or status?

Features they highlight: Which product features appear most frequently across competitors?

Brand positioning: How do they differentiate from others? (Cheapest, fastest, highest quality, most exclusive, etc.)

Ads running for months are likely performing well. Ads that disappear quickly probably didn't work.

What to track:

Create a simple tracking log:

This tracking becomes exponentially easier with automated monitoring and historical archive features available in advanced tools.

Create a competitive intelligence document or presentation including:

Overview section: Summary of competitor advertising activity levels and notable trends

Key messaging insights: Common themes, unique positioning angles, and white space opportunities

Creative insights: Visual trends, format preferences, and standout creative approaches

Opportunities for differentiation: What no one else is doing that you could own

Inspiration for upcoming campaigns: Specific ads or approaches to test, adapted for your brand

💡 PRO TIP: Include both "what to do" and "what to avoid" sections based on patterns you see competitors abandoning quickly.

The true value emerges when you transform observations into actionable campaign improvements.

When you identify ads running for 3+ months:

1. Deconstruct the structure

2. Adapt, don't copy Take the underlying formula and apply it to your unique value proposition. If a competitor's ad says "Get restaurant-quality meals in 15 minutes," and that's running successfully, the formula is: [outcome] + [time frame]. Your version might be "Launch your website in 1 hour" if you're in web hosting.

3. Test variations Create multiple versions testing different elements of the formula:

The tool helps identify underserved angles:

Unaddressed pain points: Problems your competitors aren't mentioning. If everyone focuses on speed but no one mentions ease of use, that's white space.

Unused ad formats: If everyone uses static images, video might stand out. If everyone uses video, simple, clean static images might break through.

Differentiation opportunities: Claims or benefits no one else emphasizes. This could be your unique positioning.

Target audience gaps: Demographics or psychographics being overlooked. Maybe everyone targets millennials but Gen X is underserved.

Organize saved ads by:

Campaign objective:

Ad format and creative style:

Industry vertical or use case:

Emotional approach:

Seasonal themes:

This organized library becomes invaluable when briefing creative teams or starting new campaigns. Advanced tools make this organization automatic with AI-powered tagging and custom collections, but you can create manual systems using folders and spreadsheets.

By tracking competitor advertising patterns over time, you can:

Anticipate seasonal campaigns: Know when competitors typically launch holiday promotions, plan yours accordingly

Identify testing patterns: Recognize when competitors are in test mode (lots of variations) vs. scaling winners (same ad running consistently)

Time your launches strategically: Avoid competitive advertising periods if you have limited budget, or embrace them if you want to capture comparative shoppers

Example: If you track competitors for a year and notice they all launch big promotions the first week of January, you have two strategic options:

Launch the last week of December to capture early shoppers

Wait until late January when competition quiets down and CPMs drop

While the tool is public, responsible use requires understanding both legal and ethical boundaries.

The library is specifically designed for public access and transparency.

You are legally permitted to:

This is explicitly allowed by Meta's terms for the tool.

Even though it's legal, certain uses raise ethical concerns:

Direct copying: Plagiarizing exact ad copy or creative is unethical and potentially trademark-infringing. "Inspired by" is fine. Copy-paste is not.

Misrepresentation: Using competitor ads to make false claims about their business practices or results

Bad faith competitive attacks: Leveraging ad research solely to harm competitors rather than improve your own marketing

Client confidentiality: If you're an agency, using insights from one client's research to benefit another client in the same space violates confidentiality

According to Moz's ethical marketing guidelines, adaptation and inspiration are acceptable, but direct plagiarism violates both ethical standards and potentially copyright law.

❌ Unethical: Copying a competitor's ad word-for-word, just changing the brand name

✓ Ethical: Identifying that long-form storytelling ads are performing well in your industry, then creating your own unique story

❌ Unethical: Using identical images or videos from competitor ads

✓ Ethical: Noting that lifestyle imagery outperforms product-only shots, then commissioning your own lifestyle photography

❌ Unethical: Replicating a competitor's offer exactly (same discount, same terms) immediately after they launch it

✓ Ethical: Observing that limited-time offers generate urgency, then creating your own unique promotional strategy

While accessing the library doesn't require accepting specific terms, automated scraping or data collection at scale may violate Meta's broader Terms of Service.

This is one reason why using approved third-party tools is preferable to building homemade scrapers—they operate within platform guidelines while providing superior functionality.

The advertising landscape continues evolving toward greater transparency, creating both opportunities and challenges.

1. AI-powered insights Tools increasingly use machine learning to:

2. Cross-platform integration As consumers interact with brands across multiple channels, ad intelligence tools are expanding beyond Facebook to include:

All in unified dashboards for comprehensive competitive view.

3. Real-time alerts Rather than manual checking, sophisticated tools now offer alerts when:

4. Deeper performance data While Meta limits performance data in the library, third-party tools are finding creative ways to estimate:

Privacy laws like GDPR and CCPA are reshaping digital advertising, but ad transparency tools remain compliant by:

What this means for you: Ad intelligence tools will continue to be available and valuable, even as privacy regulations tighten. The focus on ad creative and messaging—rather than individual user behavior—keeps these tools compliant.

As advertising becomes more complex and competitive, the limitations of free tools become more costly.

According to TechCrunch's marketing technology analysis, the time saved and insights gained through dedicated platforms increasingly justify their investment, particularly for:

E-commerce brands in competitive niches: When you're competing with dozens of brands for the same customers, superior intelligence provides measurable advantage

Digital marketing agencies managing multiple clients: Manual research doesn't scale across 10, 20, or 50+ client accounts

In-house marketing teams at growth-stage companies: As your ad spend grows from $10K to $100K+ per month, research efficiency directly impacts ROI

Media buyers optimizing significant ad budgets: Even a 3-5% improvement in campaign performance pays for tools many times over

Five years ago, competitive ad research was a nice-to-have. Today, it's a must-have for serious digital marketers.

The shift:

The brands winning in 2025 aren't those with the biggest budgets—they're those with the best intelligence about what's working in their market.

Transform ad intelligence from occasional activity to competitive advantage with this structured approach.

Day 1-2: Competitor Identification

Day 3-4: Initial Audits

Day 5-6: Documentation System

Day 7: Review and Planning

📊 CHECKPOINT: If you spent more than 8 hours on Week 1 research, automated tools will likely save you time and money in the long run.

Day 8-10: Pattern Recognition

Day 11-13: White Space Discovery

Day 14: Tracking Setup

Tools consideration: If manual research is consuming 10+ hours weekly, calculate the ROI of automation. Time spent × your hourly rate often exceeds the cost of dedicated tools.

Day 15-17: Creative Briefing

Day 18-20: Campaign Development

Day 21: Process Refinement

Day 22-24: Results Tracking

Day 25-27: Process Evaluation

Day 28-30: Strategic Decision

Final assessment questions:

Is manual research taking 8+ hours per month?

Do you need historical data for seasonal planning?

Are you managing multiple brands/clients?

Is your ad spend significant enough that better intelligence would improve ROI?

Does your team need collaborative access to organized insights?

If you answered "yes" to 2+ questions, advanced tools likely justify their cost.

The tool represents a fundamental shift in advertising transparency, giving marketers unprecedented visibility into competitor strategies. Here's what you need to remember:

The free tool is perfect for occasional research and getting started with competitive intelligence. But if you're spending 8+ hours monthly on manual research, or if you need historical data and team collaboration, the time cost exceeds the monetary cost of professional tools.

Don't just collect ads—analyze patterns:

Inspiration is ethical. Plagiarism is not. Understand the formulas behind successful ads and apply them to your unique value proposition. The goal is to be informed by competitors, not to become a clone.

Occasional browsing = Entertainment

Systematic research = Competitive advantage

Set up a regular cadence, document findings, and track changes over time. This compounds into deep market intelligence.

The tool shows you what competitors are running, but not:

Build a complete picture by combining multiple intelligence sources.

If you're in e-commerce, retail, B2C services, or any seasonal business, not having access to historical campaign data seriously limits strategic planning. You need to see what worked last holiday season, last back-to-school period, or last summer.

If more than one person needs competitive insights, makeshift screenshot folders and email chains break down quickly. Invest in proper organization—either dedicated tools or very disciplined manual systems.

The goal isn't to become an ad researcher. The goal is to create better campaigns based on market intelligence. Always connect research to action:

Your time has a dollar value. If you're spending 10 hours monthly on manual research and your time is worth $100/hour, that's $1,000/month in time cost. Most professional ad intelligence tools cost $200-500/month. The math often favors automation.

The democratization of ad intelligence means small brands can compete with enterprise competitors by being smarter, not just bigger. The difference between winning and losing is often having better information about what works in your market.

You now have a comprehensive understanding of how to use the Facebook Ad Library for competitive research, its limitations, and when to upgrade to more advanced solutions.

Your next steps depend on your situation:

Begin with the free tool

Follow the 30-day action plan above

Build the habit of systematic competitive research

Document what you learn

Apply insights to your campaigns

Assess how much time you're actually spending

Calculate whether efficiency improvements would justify investment

Identify your biggest frustrations (no downloads? No history? No team sharing?)

Trial advanced platforms that solve your specific pain points

Make a data-driven decision about upgrading

The free tool likely doesn't scale to your needs

Calculate total time spent across all accounts

Research dedicated platforms designed for agency workflows

Invest in proper ad intelligence infrastructure

Turn competitive intelligence into a systematized service offering

When the limitations of the free tool are costing you more in time than advanced tools cost in money, it's time to upgrade. Professional platforms offer:

The difference between occasional ad browsing and systematic competitive intelligence is the difference between hoping for success and engineering it.

Every hour invested in understanding your competitive landscape compounds over time, building deeper market knowledge that informs better strategic decisions.

If you've found the limitations of the Facebook Ad Library frustrating, you're not alone. Thousands of marketers have moved to more sophisticated solutions that save time while providing deeper insights.

What professional ad intelligence platforms offer:

✓ Historical archives of ads going back months or years

✓ Bulk download capabilities (entire libraries in minutes)

✓ Advanced filtering by format, objective, performance

✓ AI-powered insights identifying winning patterns automatically

✓ Team collaboration tools for sharing and organizing

✓ Multi-platform coverage (Facebook, Instagram, TikTok, LinkedIn, YouTube)

✓ Real-time alerts when competitors launch new campaigns

✓ Performance indicators estimating which ads work best

The investment in better intelligence typically pays for itself through:

Most professional platforms offer free trials that let you experience the difference firsthand:

Ananya Namdev

Content Manager Intern, IDEON Labs

Rahul Mondal

Product & Strategy, Ideon Labs

Rahul Mondal

Product & Strategy, Ideon Labs

Get notified when new insights, case studies, and trends go live — no clutter, just creativity.

Table of Contents